Investment approach

Building Partnerships.

EMH Partners represents an entrepreneurial-led and visionary approach towards investment. We partner with outstanding entrepreneurs and management teams. We enable entrepreneurs to think bigger, overcome limitations and realize their full potential.

Our experienced team has in depth expertise across Healthcare, Software, and Industries sectors. What proves our approach is not only the numbers and the returns above market level, but also the unifying power that strong personalities can provide.

This shared vision for growth is based on entrepreneurial thinking, empathy and a down-to-earth attitude, and it creates inspiring partnerships between investors, entrepreneurs and experts. Financial investments become a network that delivers sustainable benefits.

EMH Growth Funds

Growth capital for the European Mittelstand.

In 2016 we launched the EMH Digital Growth Fund to focus on investments in medium-sized businesses (Mittelstand). Our strategy is based on our entrepreneurial approach, our digital competence and experience as investors. We close a gap that exists between venture capital and classic buyout funds, where there is little capital available for growth financing.

EMH Growth Fund I

The first EMH Growth Fund was closed in 2016 at €350 million hard cap, with additional €350 million available through a co-investment program.

EMH Growth Fund II

The second EMH Growth Fund was closed in 2020 at €650 million hard cap, excluding co-investments.

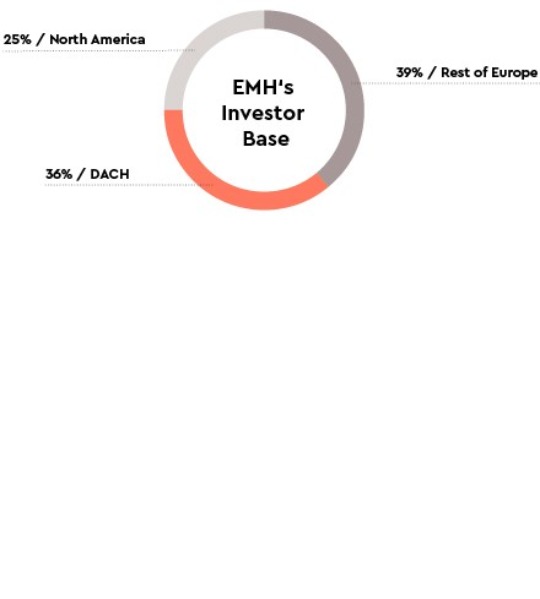

Investors

A diverse group of institutional investors.

EMH’s investor base is built up from different groups of international investors – in particular leading institutional investors, including large pension funds, insurance companies and leading European families. The EMH team itself is among the investors as well.

We do not only believe in EMH’s investment philosophy. We are part of it.

Building Partnerships

UN PRI – United Nations Principles for Responsible Investment

In 2020, EMH became a signatory to the United Nations Principles for Responsible Investment (PRI). As a leading growth investment firm, we have a responsibility to act in our stakeholders’ best and long-term interests. In this role, we believe that environmental, social, and corporate governance (ESG) matters impact the performance of our portfolio companies. As a signatory, we incorporate ESG topics into all our decision-making processes.

EDCI – ESG Data Convergence Initiative

As of June 2024, EMH Partners is a member of the ESG Data Convergence Initiative (EDCI). EMH Partners will actively contribute to driving ESG data convergence and is committed to following best market practices.